A Smart Shift That’s Keeping India’s Digital Giant on Track

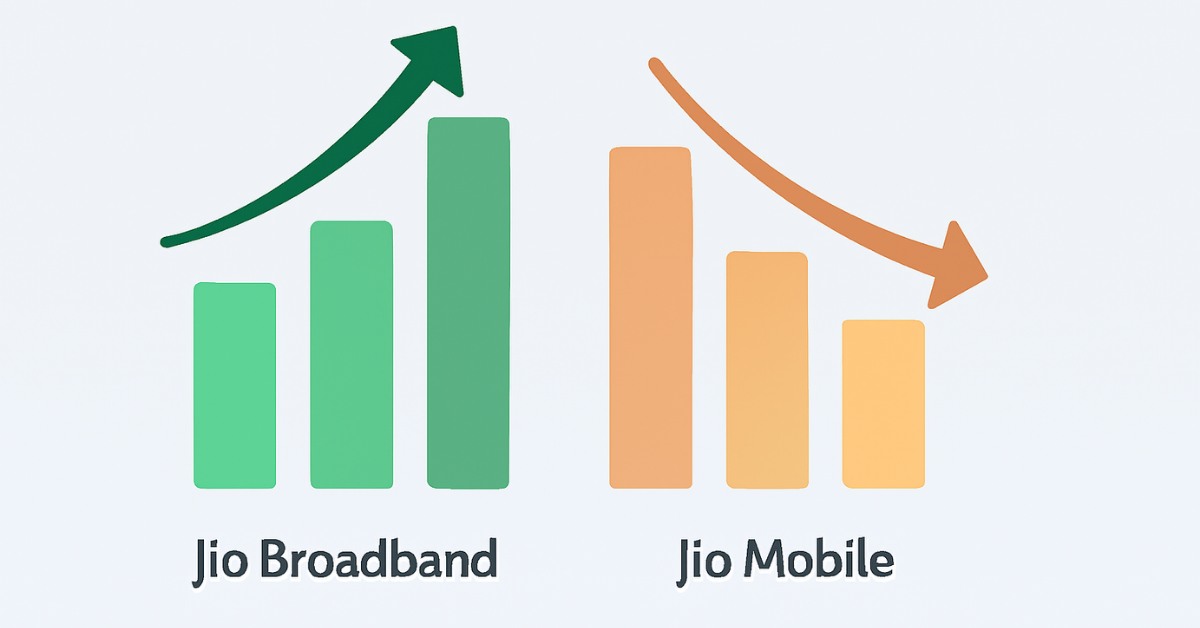

In a country where connectivity is everything, Reliance Jio continues to evolve with the times. While mobile subscriber growth has slowed down in recent months, Jio broadband segment is booming—and it’s happening at just the right time. With Jio Platforms gearing up for its much-anticipated IPO in the first half of 2026, the company’s strategic pivot toward home broadband and premium services is proving to be a masterstroke.

Let’s explore how Jio broadband growth is offsetting the mobile slowdown, what this means for its IPO prospects, and why this shift is a win for both users and investors.

Jio Broadband Growth: Strongest Ever Quarter

According to the latest reports, Jio’s home broadband segment posted its highest-ever quarterly growth in the July–September 2025 period. The company added 3 million new broadband subscribers, driven largely by the rising demand for fixed wireless access (FWA) solutions.

This surge in Jio broadband users comes at a time when mobile additions have slowed. Jio added 8 million total subscribers, but only 5 million were mobile users—missing analyst expectations. The broadband segment, however, picked up the slack, showcasing Jio’s ability to adapt and diversify.

Why Broadband Is the New Growth Engine

Jio broadband success isn’t just about numbers—it’s about strategy. Here’s why this segment is growing so rapidly:

- Fixed Wireless Access (FWA): Jio’s innovative FWA solutions are bringing high-speed internet to areas where fiber isn’t feasible.

- Standalone 5G Network: Jio’s pan-India 5G rollout is enabling faster, more reliable broadband connections.

- Affordable Plans: Competitive pricing and bundled services make Jio broadband attractive to middle-income households.

- Digital Shift: More users are working, learning, and streaming from home, increasing demand for stable broadband.

This growth is helping Jio maintain momentum even as mobile user acquisition slows due to market saturation and competition.

Financial Performance: Profits and Revenue Rise

Jio Platforms reported a 13% year-on-year rise in net profit, reaching ₹7,375 crore in Q2 FY26. Revenue from operations also grew 14.6% YoY, beating street estimates and reinforcing investor confidence.

This financial strength is crucial as Jio prepares for its IPO. Analysts believe that sustained broadband growth and a shift toward higher-value customers will help Jio secure a strong valuation when it hits the stock market.

Mobile Segment: Slower But Still Steady

While mobile user additions were slower than expected, Jio still added 5 million mobile subscribers in Q2. The slowdown is attributed to:

- Market saturation in urban areas

- Intense competition from Airtel and Vi

- Focus on premium users rather than mass onboarding

Despite the dip, Jio’s mobile segment remains profitable, with steady ARPU (average revenue per user) and low churn rates.

Broadband vs Mobile: A Strategic Balance

Here’s a quick comparison of Jio broadband and mobile performance in Q2 FY26:

| Segment | Subscriber Additions | Growth Driver | Challenges |

|---|---|---|---|

| Broadband | 3 million | FWA, 5G, home demand | Infrastructure rollout |

| Mobile | 5 million | Premium user targeting | Market saturation, competition |

This balance between broadband and mobile ensures Jio remains resilient and adaptable in a dynamic telecom landscape.

What This Means for Jio’s IPO

Jio Platforms is expected to launch its IPO in the first half of 2026. The company’s broadband momentum is likely to play a key role in:

- Boosting investor confidence

- Justifying higher valuations

- Diversifying revenue streams

- Showcasing innovation in connectivity

Analysts also anticipate tariff hikes in the coming months, which could further improve profitability and strengthen Jio’s IPO pitch.

Final Thoughts – Jio’s Smart Play for the Future

Jio’s ability to pivot from mobile to broadband growth shows why it remains a leader in India’s digital revolution. As the company prepares for its IPO, its focus on innovation, infrastructure, and premium services is setting the stage for long-term success.

For users, this means better connectivity and smarter solutions. For investors, it signals a company that’s not just surviving—but thriving.

Disclaimer

This article is based on publicly available news reports and financial data as of October 23, 2025. Figures and projections may change over time. Readers are advised to consult official sources and financial advisors for the most accurate and updated information.